In a strategic move to stabilize its economy, Zimbabwe has announced plans to establish a new gold-backed currency, known as ZiG (Zimb Gold), as the sole legal tender by 2030. The announcement was made by Information Minister Jenfan Muswere during a media briefing on Tuesday, following a cabinet meeting in the capital, Harare.

Minister Muswere outlined the government’s de-dollarization roadmap, a comprehensive strategy to transition to ZiG. He emphasized that a detailed plan has been laid out, focusing on the implementation of ZiG as the primary currency for economic transactions. The initiative aims to phase out the US dollar, which currently dominates Zimbabwe’s financial landscape.

“On modalities to operationalise ZiG as legal tender for use in the economy, a de-dollarization roadmap is now in place with a time frame, as presented by the Minister of Finance, Economic Development, and Investment Promotion,” Muswere told reporters.

Historically, the Zimbabwe dollar (ZWD) was introduced in 1980, replacing the Rhodesian dollar at par. Initially, the ZWD symbolized national pride. However, it quickly fell victim to a severe cycle of hyperinflation and economic instability, leading to multiple currency changes over the years. By 2009, Zimbabwe abandoned the ZWD due to its rapid depreciation and hyperinflation.

Since 2009, Zimbabwe has depended significantly on the US dollar, which now constitutes approximately 70% of all economic transactions, according to Bloomberg. The ZiG, launched in April, represents the government’s sixth attempt in 15 years to stabilize the local currency. Backed by 2.5 tons of gold and $100 million in foreign currency reserves, the ZiG aims to restore confidence in Zimbabwe’s monetary system.

The International Monetary Fund (IMF) reported in late June that the ZiG’s official exchange rate has remained stable, bringing some relief after a period of macro-economic instability earlier in the year. The IMF projected that, assuming macro-economic stabilization continues, cumulative inflation for the remainder of 2024 could be around 7 percent. To achieve price stability, the IMF recommended stabilizing the ZiG’s nominal exchange rate against a basket of currencies, considering the USD’s dominant role in the economy.

In July, President Emmerson Mnangagwa suggested that ZiG could become Zimbabwe’s sole legal tender by 2026, ahead of the initial 2030 target. This accelerated timeline reflects the government’s commitment to transitioning away from the US dollar.

On Tuesday, Minister Muswere also addressed measures to combat economic misconduct related to the new currency. The government plans to increase penalties for various offenses, including unjust price hikes, currency manipulation, smuggling, and other unfair trade practices. Fines will range from a minimum of $200 to a maximum of $5000, or the equivalent in ZiG.

The transition to ZiG marks a significant shift from the troubled history of the Zimbabwean dollar. Following years of hyperinflation and economic distress, the ZWD was demonetized in 2009 and officially ceased to exist in 2015. The Zimbabwean government then permitted the use of foreign currencies, including the US dollar, euro, and South African rand, effectively abandoning the local currency.

Subsequently, Zimbabwe adopted a multi-currency system, allowing various foreign currencies to circulate alongside local alternatives. Among these were the Botswana Pula, Indian Rupee, Euro, US dollar, and South African rand. The US dollar emerged as the most widely accepted currency, becoming the dominant medium of exchange.

In response to the economic crisis, the government introduced bond notes in 2016, pegged at a 1:1 exchange rate with the US dollar. However, these measures did not suffice to stabilize the economy. The Zimbabwe dollar underwent several re-denominations in 2006, 2008, and 2009 in an attempt to combat hyperinflation. The first re-denomination, known as “Operation Sunrise,” revalued the ZWD at 1000:1 in 2006. Despite these efforts, hyperinflation persisted, leading to a third re-denomination in 2009, with one trillion third dollars exchanged for a single fourth-issue dollar. Ultimately, these measures failed to stabilize the currency.

As Zimbabwe embarks on this new phase with ZiG, the government hopes to establish a more stable and reliable currency system. The success of this transition will depend on the effective implementation of the de-dollarization roadmap and the government’s ability to address economic challenges and restore confidence in the national currency.

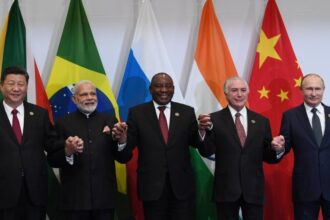

ALSO READ: De-dollarisation, a single unified BRICS currency not on the cards