Jonathan Munemo, Salisbury University

Highly indebted African countries are facing stark trade-offs between servicing expensive debt, supporting high and growing development needs, and stabilising domestic currencies.

Government debt has risen in at least 40 African countries over the past decade. As a result, some are experiencing a bad combination of high debt, elevated development spending needs amid budget shortfalls, and unfavourable exchange rate pressures.

These issues have become more pressing since 2022, when persistently high inflation prompted major central banks around the world to embark on the most aggressive monetary tightening campaign in decades.

Monetary policy tightens when central banks raise interest rates.

Since then, global interest rates have climbed even higher, triggering a jump in repayments on external loans and adding to debt burdens accumulated over the last decade.

In addition, some countries with worsening debt situations have endured large exchange rate depreciations and struggled to stabilise the value of their domestic currencies.

My perspective, shaped by years of researching Africa’s development challenges, is that this presents many countries with a triple set of dilemmas that’s not easy to navigate.

Tackling any of one of these issues imperils the others.

Here are some examples:

- stemming the rise in public debt and containing exchange rate decreases would make it more difficult to meet bigger public spending needs

- pushing for lower public debt while supporting extra spending risks putting more strain on domestic currencies

- prioritising higher spending needs and easing currency strains runs the risk of inviting extra government debt.

Steps can be taken to expand the policy space to tackle these challenges while easing difficult trade-offs.

These steps include prioritising public spending measures that raise growth, fixing the revenue collection problem facing all African countries, and restructuring unsustainable government debt.

ALSO WATCH: South African police clash with irate Durban community as ongoing water crisis worsens

Rising government debt and policy dilemmas

The triple dilemma unfolded as government debts rose substantially over the last decade.

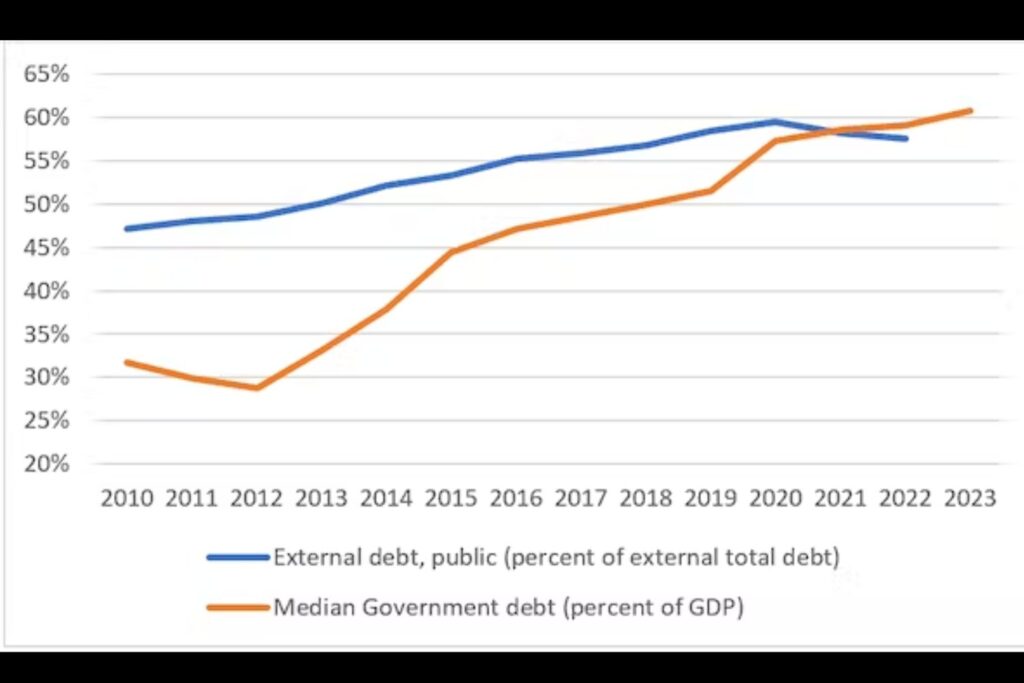

As shown in Figure 1, median government debt has more than doubled since 2012 and amounted to 61% of GDP as of 2023.

At first, historically low global interest rates in the decade after the global financial crisis in 2008 contributed powerfully to burgeoning debt by making it easy to borrow large amounts of cheap money.

The debt trends of countries have worsened sharply since then. Factors have included the COVID-19 pandemic, which triggered a cost-of-living crisis, and Russia’s invasion of Ukraine, which contributed to a rapid rise in global interest rates.

In Africa, the pain from higher borrowing costs is particularly acute for governments, given that public debt represented nearly 60% of the region’s total external debt in 2022 (Figure 1).

Nineteen countries, including Ghana and Zambia, are already in debt distress (meaning they are unable to meet financial obligations) or at high risk of debt distress.

Ghana’s public debt has more than doubled since 2012 and amounts to 85% of GDP. Zambia’s went up much higher and stood at 98% as of 2022.

Both Ghana and Zambia, along with Ethiopia, have defaulted on their foreign debt, sparking fears about a broader sovereign debt crisis on the continent if more countries fall into debt distress.

Others face high risk of debt distress. Kenya is on the edge of financial distress after its debt increased steadily to 70% of GDP.

South Africa also faces elevated public debt, which has almost doubled over the last decade and currently stands at 74% of GDP.

And yet trimming high debts won’t be easy. Development needs are high after coffers were drained by higher spending tied to the pandemic and fallout from Ukraine.

The International Monetary Fund estimates that the median sub-Saharan African country needs to increase spending by at least 20% of GDP to meet sustainable development goals on health, education and infrastructure by 2030.

ALSO READ: Africa’s savannah elephants: small ‘fortress’ parks aren’t the answer – they need room to roam

Climate change adaptation is expected to add billions of dollars each year for the continent.

Coffers are also being depleted by more money being spent repaying expensive loans.

This has the additional effect of depleting foreign exchange reserves, which means countries overburdened by debt also have to contend with weakening currencies.

Kenya’s debt interest payment as a share of revenue rose from 11% in 2014 to more than 20% after 2020.

This depleted its reserves as a share of external debt from 47% to less than 20% over the same period. This has pressured the Kenyan shilling, which lost more than 19% against the US dollar last year.

In the cases of Ghana and Zambia, debt interest payments climbed even higher. For Ghana they were around 45% of revenue.

For Zambia, around 39%. By 2022 reserves had dwindled to 22% in Ghana and to 10% in Zambia.

This precipitated large depreciations of Ghana’s cedi and Zambia’s kwacha.

ALSO READ: Diverse demographics challenge stereotypes in South Africa’s squatter camps

South Africa’s debt interest payments increased at a relatively slower pace to about 15% of revenue after 2021 and it kept a higher reserve share of about 35%.

This was why the decline in the rand was not as steep as in the other three countries.

Weakening currencies also make foreign debt servicing costlier. Consequently, reasonable debt can quickly turn into unmanageable debt.

Lower government revenue collection has also intensified debt risks.

In 2023, revenue collected was 16% of GDP in Ghana, 17% in Kenya and 21% in Zambia.

This is significantly below the 27% median level seen in other developing economies.

Although this median level is matched by South Africa, rising costs of social transfers including welfare grants and subsidies to state-owned enterprises such as the power utility Eskom and transport utility Transnet have added upward pressure on public debt amid slowing growth.

ALSO READ: South African-Saudi Arabia Business Council aims to boost bilateral trade and investment

What can be done

A number of steps can be taken to alleviate the trade-offs countries are having to make.

Firstly, governments should prioritise public spending measures that raise growth.

These include critical spending on education, health, infrastructure and other high-quality growth enhancing investments. As economic growth picks up, it is likely to generate more government revenue to pay down the debt.

It also means allocating more spending on first generation reforms. These are structural reforms that alleviate major growth constraints.

For example, long-standing reforms in governance remain critical in African countries which generally lag behind countries in other regions on various measures of governance quality such as rule of law, control of corruption and government accountability.

Secondly, countries need to fix their revenue collection problems. While growth leads to a larger economy that generates additional revenue, low levels of domestic revenue collection constrain the ability of governments to pay down debt and fund vital social and growth sectors.

Across Africa, several countries, including South Africa, Nigeria, Ghana, Zambia, Kenya and Ethiopia, have mobilised efforts to spur gains in revenue collection.

These include new levies, higher taxes, registering more shops on the tax roll, broadening tax bases, strengthening tax administration and other revenue enhancing measures.

Lastly, governments need to restructure their debt portfolios. When a debt crisis cannot be avoided, restructuring debt can reduce the amount owed to creditors by revising the amount and timing of future principal and interest payments.

Chad reached an agreement to restructure its external debt under the G20 Common Framework for Debt Treatment in 2022.

This is an initiative designed to support low income developing countries with unsustainable debt. Since then, Ghana and Zambia have also launched debt restructuring negotiations under the G20 Common Framework.

Other highly indebted countries struggling to service their liabilities may have to do the same amid rising concerns about slow progress of the Common Framework.

Jonathan Munemo, Professor of Economics, Salisbury University

*This article is republished from The Conversation under a Creative Commons license. Read the original article.