Ahead of the FOCAC Summit, a recent study conducted in China reveals that Chinese lenders have significantly increased their loan disbursements to African countries.

In 2022, eight African countries—Angola, Burkina Faso, Ivory Coast, Egypt, Eritrea, Madagascar, Nigeria, and Uganda—benefited from these loans. Chinese financial support was directed through multilateral platforms like the African Export-Import Bank and the Africa Finance Corporation, primarily for small and medium-sized enterprises and trade financing.

Although the $4.61 billion lent in 2022 marked the highest level since 2019, it remains a fraction of the substantial sums that China provided to Africa during the initial stages of its Belt and Road Initiative (BRI), as reported by the Boston University Global Development Policy Centre. During the peak years from 2013 to 2018, annual commitments frequently exceeded $10 billion, according to the updated “Chinese Loans to Africa Database.”

China’s financial relationship with Africa has become a defining feature of the continent’s development landscape. Over the past two decades, China has emerged as a key lender to African nations, providing billions of dollars in loans for infrastructure projects, energy initiatives, and other development efforts. African governments have been drawn to Chinese loans for several reasons. Unlike traditional Western lenders, China often offers loans with fewer political strings attached. This means that African nations can secure funding without adhering to stringent conditions related to governance, human rights, or economic reforms.

This uptick in lending could signal a recovery in Chinese financial activities across Africa after a prolonged slowdown and might reflect China’s revised approach to its Belt and Road infrastructure program.

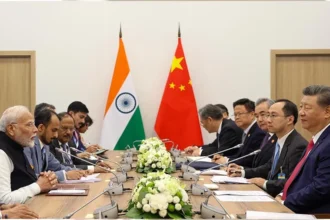

The release of this updated loan data came just before the 9th Forum on China–Africa Cooperation (FOCAC) in Beijing. Historically, China has announced significant financial commitments at FOCAC summits, funding major infrastructure projects across Africa, including ports, railways, power dams, and highways. In a letter addressed to a group of African scholars last Monday, President Xi Jinping emphasized the need for greater “intellectual support” for Global South and China-Africa cooperation. He stressed the importance of strengthening solidarity and collaboration, particularly in light of the current volatile geopolitical landscape.

Experts have pointed out the difficulties to predict the scale of pledges at the FOCAC summit, it’s likely that the commitments will be more varied and cover a broader range of cooperation areas compared to earlier FOCACs.

The data from Boston University also revealed that Chinese lenders are increasingly channeling funds through African multilateral financial institutions for on-lending purposes. Last year, over half of the total loan amount, or $2.59 billion, was provided to African multilateral banks and nationally owned banks in Egypt. This is a significant shift, as less than 6% of Chinese loans to Africa were directed toward the continent’s financial sector between 2000 and 2022, according to the database.

In 2022, China Development Bank (CDB) and China Exim Bank provided two loans totaling $700 million for on-lending to small and medium-sized enterprises, along with two additional loans amounting to $900 million for trade financing to three African regional borrowers and the National Bank of Egypt. The Central Bank of Egypt also received a 7 billion yuan ($988 million) loan from CDB for liquidity support.

The study highlights that between 2000 and 2023, Chinese lenders issued 1,306 loans totaling $182.28 billion to 49 African governments and seven regional borrowers. Angola remained the top recipient of Chinese loans, securing $46.05 billion, followed by Ethiopia, Egypt, Nigeria, Kenya, Zambia, South Africa, Sudan, Ghana, and Cameroon. These ten countries accounted for 68% of the funds committed by Chinese lenders during this period.

During this time, China’s loans were primarily directed toward Africa’s energy sector, which received $62.72 billion, followed by the transportation, information, communication technology, and financial sectors. After a two-year pause in energy lending, Chinese lenders last year committed $501.98 million to three renewable energy projects in Africa, according to the 2000-2023 database.

Despite the benefits, China’s lending practices in Africa have also attracted criticism. One of the primary concerns is the debt burden that these loans place on African countries. Many of these loans are issued on non-concessional terms, meaning they carry higher interest rates and shorter repayment periods compared to concessional loans. This has led to fears of a “debt trap,” where countries become overly dependent on Chinese financing and struggle to repay their debts.

In response to the growing concerns about debt sustainability, some African countries have begun to reassess their borrowing strategies. There is an increasing emphasis on ensuring that Chinese-funded projects are economically viable and contribute to long-term development goals.

While Chinese loans have undoubtedly contributed to Africa’s development, they have also raised important questions about debt sustainability, economic independence, and the broader implications of China’s growing influence on the continent. However China and Africa are focusing on making its economic partnerships more sustainable and resilient in the face of evolving global challenges.

ALSO READ: BRICS bank approves $1 billion loan for water projects in South Africa

Your article helped me a lot, is there any more related content? Thanks!