The Federation Council of Russia has passed a bill that legitimizes cryptocurrency mining and permits the central bank to authorize certain businesses for cross-border transactions and digital currency exchange trading. The bill, awaiting President Vladimir Putin’s signature to become law, enables both legal entities and individual entrepreneurs approved by the Ministry of Digital Development, Communications, and Mass Media to engage in cryptocurrency mining.

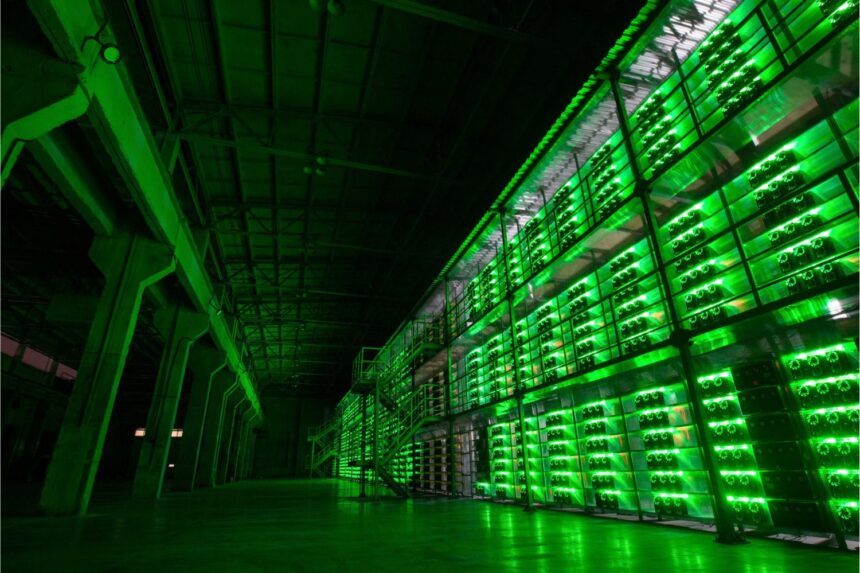

This legislation also imposes a ban on advertising cryptocurrencies and offering them to the general public. This restriction will be enforced ten days after the law is officially published. Cryptocurrency mining is a crucial aspect of the blockchain ecosystem, involving the process of validating and adding transactions to a blockchain ledger. This process secures the network and ensures the integrity of transactions. The concept of cryptocurrency mining was introduced with Bitcoin in 2009 by an anonymous entity known as Satoshi Nakamoto.

Bitcoin’s proof-of-work (PoW) mechanism required miners to solve complex mathematical problems to add a new block to the blockchain and earn rewards in the form of new bitcoins. For countries facing economic sanctions or dependence on the U.S. dollar, such as Russia, adopting cryptocurrencies can offer greater monetary sovereignty. Cryptocurrencies can provide an alternative to the global financial system dominated by the U.S. and help circumvent economic restrictions.

The regulatory environment for cryptocurrency mining varies widely across different jurisdictions. While some countries have embraced mining, others have imposed restrictions or outright bans due to concerns over energy consumption, financial stability, and illicit activities.

The law requires crypto miners to report their digital currency acquisitions from mining activities to a state-authorized body. The government retains the authority to impose bans or restrictions on digital currency transactions to ensure Russia’s monetary stability. The majority of amendments related to the mining process are expected to take effect on November 1.

The new legislation also introduces a special experimental regime under which the central bank can authorize selected companies to utilize cryptocurrency for international payments and exchange trading. This measure is slated to be implemented later this month.

Cryptocurrencies can enhance financial inclusion by providing access to financial services for unbanked and underbanked populations. With a significant portion of the population in BRICS countries lacking access to traditional banking, cryptocurrencies can offer an alternative means of saving, transferring, and investing money. Adopting cryptocurrencies can diversify the economies of BRICS countries, which often rely on traditional sectors such as manufacturing, agriculture, and natural resources.

Embracing digital currencies can foster innovation and create new economic opportunities in the fintech sector. Cryptocurrencies are currently not permitted for payments in Russia, a policy that would significantly change with the new legislation. Elvira Nabiullina, the head of the Bank of Russia, has indicated that the regulator plans to conduct its first cross-border crypto payments by the end of this year.

One of the main disadvantages is the regulatory uncertainty surrounding cryptocurrencies. Developing comprehensive regulations that balance innovation with consumer protection, anti-money laundering (AML), and combating the financing of terrorism (CFT) can be challenging and time-consuming. Cryptocurrencies can be used for illicit activities due to their pseudonymous nature.

Money laundering, tax evasion, and financing illegal activities can be facilitated through cryptocurrencies, posing a challenge for law enforcement agencies. The adoption of cryptocurrencies by BRICS countries offers numerous potential benefits, including financial inclusion, economic diversification, and enhanced security. However, it also presents significant challenges, such as regulatory complexity, volatility, and cybersecurity risks.

The success of cryptocurrency adoption in these nations will depend on their ability to navigate these challenges while leveraging the opportunities presented by digital currencies. Cryptocurrency mining has come a long way from its humble beginnings, driven by technological advancements and evolving market dynamics. As the industry continues to mature, it will need to balance profitability with environmental sustainability and regulatory compliance to ensure its long-term viability.

ALSO READ: Alcohol consumption in Russia almost halved since 2009 – deputy PM

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.